If you’re looking for a low-risk investment option that offers a fixed rate of return, investing in high-rated bonds and Non-Convertible Debentures (NCDs) can be a great option for you. In this article, we’ll cover everything you need to know about investing in bonds and NCDs, including what they are, how to invest in them, and some of the best options available in the USA and worldwide market.

1. What are Bonds and NCDs?

Bonds and NCDs are both debt instruments issued by corporations, governments, and other entities to raise funds. When you invest in a bond or NCD, you’re essentially lending money to the issuer, who agrees to pay you back with interest over a set period of time.

Bonds are typically issued by governments and corporations, while NCDs are issued only by corporations. Bonds usually have longer maturities and higher credit ratings than NCDs, which makes them a more secure investment option. NCDs, on the other hand, are typically shorter-term investments with higher interest rates.

2. How to Invest in Bonds and NCDs

There are several ways to invest in bonds and NCDs, including through mutual funds, exchange-traded funds (ETFs), and direct purchases. Mutual funds and ETFs are a great option for investors who want to diversify their portfolio without having to choose individual bonds or NCDs.

Direct purchases, on the other hand, give investors more control over their investments and can potentially offer higher returns. However, they require more research and knowledge of the bond and NCD market.

3. Benefits of Investing in Bonds and NCDs

Investing in bonds and NCDs can offer several benefits, including:

- Low-risk investments with predictable returns

- Regular income in the form of interest payments

- Diversification of investment portfolio

- Protection against inflation

- A fixed rate of return

4. Risks Associated with Bond and NCD Investments

While bonds and NCDs are generally considered to be low-risk investments, there are some risks to be aware of, including:

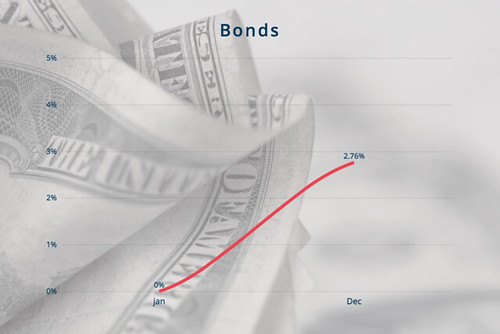

- Interest rate risk: When interest rates rise, the value of bonds and NCDs decreases.

- Credit risk: The risk that the issuer will default on its payments.

- Inflation risk: The risk that inflation will decrease the value of the investment over time.

- Liquidity risk: The risk that the investment cannot be sold quickly or at a fair price.

5. Best Bond and NCD Investment Options in the USA and Worldwide Market

There are several bond and NCD investment options available in the USA and worldwide market, including:

- US Treasury bonds and notes

- Corporate bonds

- Municipal bonds

- International bonds

- High-yield bonds

When choosing a bond or NCD investment, it’s important to consider factors such as credit rating, maturity, and interest rate.

6. Tips for Choosing the Right Bond or NCD Investment

When choosing a bond or NCD investment, it’s important to consider several factors, including:

- Credit rating: Choose bonds and NCDs with high credit ratings, which indicate that the issuer is more likely to repay its debts.

- Maturity: Longer-term bonds and NCDs typically offer higher returns, but they also carry more risk.

- Interest rate: Compare the interest rates of different bonds and NCDs to find the best return on your investment.

- Diversification: Diversifying your bond and NCD investments across different issuers and industries can help reduce risk.

It’s also important to do your research and stay up-to-date on market trends and changes in interest rates, which can impact the value of your investments.

7. Taxation of Bond and NCD Investments

Bonds and NCDs are taxed differently than other investments, such as stocks and mutual funds. Interest income from bonds and NCDs is taxed at your regular income tax rate, which can be higher than the tax rate for long-term capital gains on other investments.

However, some types of bonds, such as municipal bonds, are exempt from federal income tax, which can make them a more attractive investment option for some investors.

8. How to Buy Bonds and NCDs Online

Online marketplaces like Fidelity, Vanguard, and Schwab offer a wide selection of bonds and NCDs for investors to choose from. You can also purchase bonds and NCDs directly from the issuer or through a broker.

Before buying bonds or NCDs online, make sure to read the prospectus carefully and understand the terms and risks of the investment.

9. Find Your First Bond or NCD Today

Investing in bonds and NCDs can be a great way to diversify your portfolio and earn a steady stream of income. With the largest collection of bonds and NCDs available online, finding the right investment has never been easier.

Whether you’re a first-time investor or an experienced trader, start your bond and NCD investment journey today and find the right investment for your financial needs.

10. Conclusion

Investing in high-rated bonds and NCDs can be a great option for investors looking for low-risk investments with predictable returns. While there are some risks associated with bond and NCD investments, with proper research and diversification, they can offer several benefits, including regular income and protection against inflation.

When choosing a bond or NCD investment, consider factors such as credit rating, maturity, and interest rate. Online marketplaces offer a wide selection of bonds and NCDs for investors to choose from, making it easier than ever to start your bond investment journey.

11. FAQs

- What is the difference between bonds and NCDs?

- Bonds are debt instruments issued by governments and corporations, while NCDs are only issued by corporations.

- Bonds typically have longer maturities and higher credit ratings than NCDs.

- What are the benefits of investing in bonds and NCDs?

- Low-risk investments with predictable returns

- Regular income in the form of interest payments

- Diversification of investment portfolio

- Protection against inflation

- A fixed rate of return

- What are the risks associated with bond and NCD investments?

- Interest rate risk

- Credit risk

- Inflation risk

- Liquidity risk

- How can I buy bonds and NCDs online?

- Online marketplaces like Fidelity, Vanguard, and Schwab offer a wide selection of bonds and NCDs for investors to choose from.

- What should I consider when choosing a bond or NCD investment?

- Credit rating

- Maturity

- Interest rate

- Diversification.