Warren Buffett, the renowned investor and billionaire, has made headlines for his successful investments in the stock market. Over the past 18 months, Buffett has deployed an impressive $61 billion in the stock markets. This has led many to wonder about his approach to market timing and the lessons that can be learned from his strategies.

1. The Myth of Timing the Market

The concept of timing the market refers to the practice of trying to predict the best time to buy or sell stocks based on market trends and economic indicators. Many investors believe that by accurately timing their trades, they can maximize their returns and avoid losses. However, market timing is widely regarded as a risky and unreliable strategy.

2. Warren Buffett’s View on Market Timing

Despite the allure of market timing, Warren Buffett has repeatedly emphasized that it is a futile endeavor. He famously stated, “Trying to time the market is a waste of time and hazardous to investment success.” Buffett’s approach to investing is rooted in long-term value creation rather than short-term market fluctuations.

3. Buffett’s Cash Position and Strategic Investments

It is worth noting that despite Buffett’s stance on market timing, he found himself sitting on a record amount of cash, nearly $90 billion in December 2021. This raises the question: why did Buffett wait to deploy this capital rather than invest it immediately?

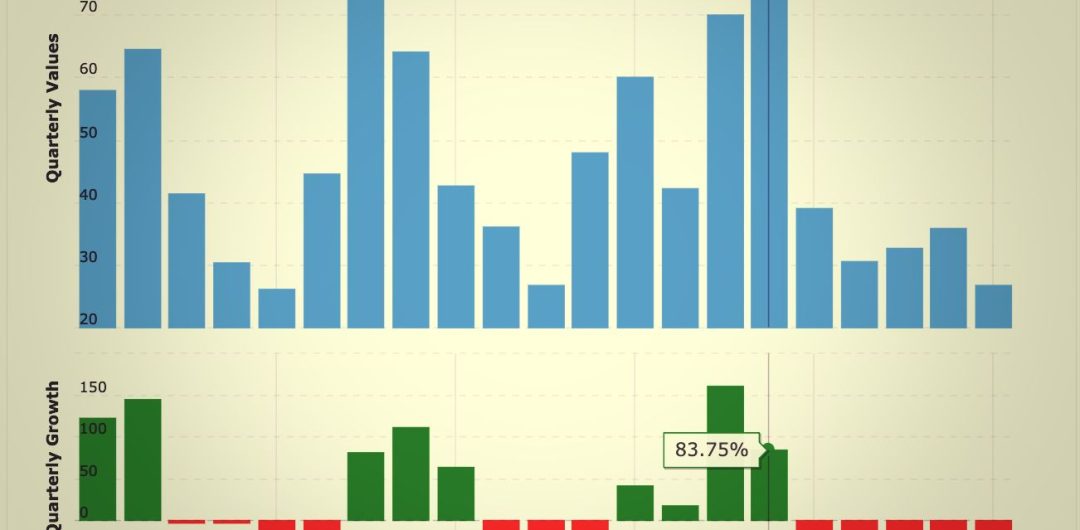

Buffett’s decision to hold onto a significant cash position reflects his disciplined investment strategy. He patiently waits for favorable market conditions and attractive investment opportunities. When the market presents undervalued assets, Buffett seizes the opportunity to make substantial investments, as he did in the past 18 months.

4. The Retail Investor’s Dilemma

In contrast to Buffett’s deliberate approach, many retail investors tend to engage in frequent buying and selling activities. They often rely on systematic investment plans (SIPs) or regularly investing fixed amounts in the market. However, these investors often fail to book profits sensibly or cut their losses, leading to poor returns.

Statistics from the Securities and Exchange Board of India (SEBI) indicate that approximately 90% of traders and a significant number of retail investors lose money in the stock markets. This further highlights the challenges faced by individuals attempting to time the market without a comprehensive understanding of market dynamics.

5. The Wisdom of Buffett’s Investment Approach

When Buffett advises against timing the market, he does so in a broader context. His philosophy emphasizes the importance of focusing on quality investments and purchasing them at reasonable prices. Buffett views the stock market as a platform for acquiring valuable assets and selling them when they become overvalued.

By following this approach, Buffett has achieved remarkable success in the stock market over the years. His long-term perspective and ability to identify undervalued opportunities have enabled him to generate substantial wealth for his shareholders.

Conclusion

Warren Buffett’s investment strategy provides valuable insights for investors and traders alike. While he discourages market timing, he demonstrates the significance of patience, discipline, and a long-term perspective. By avoiding impulsive buying and selling decisions, investors can enhance their chances of generating sustainable returns in the stock market.

FAQs

- Is market timing a reliable strategy? Market timing is widely regarded as a risky and unreliable strategy due to the unpredictability of market movements. It is challenging to consistently predict the best times to buy or sell stocks.

- Why did Warren Buffett wait to invest his cash? Buffett’s decision to hold onto a significant cash position demonstrates his disciplined investment approach. He waits for favorable market conditions and attractive investment opportunities before deploying capital.

- Why do retail investors often lose money in the stock markets? Retail investors often struggle to time their trades effectively and tend to engage in frequent buying and selling activities without a comprehensive understanding of market dynamics, leading to poor returns.

- What is Warren Buffett’s investment philosophy? Buffett focuses on identifying quality investments at reasonable prices. He believes in acquiring valuable assets and selling them when they become overvalued.

- How can investors enhance their chances of success in the stock market? Investors can improve their chances of success by adopting a patient, disciplined approach, avoiding impulsive decisions, and maintaining a long-term perspective.